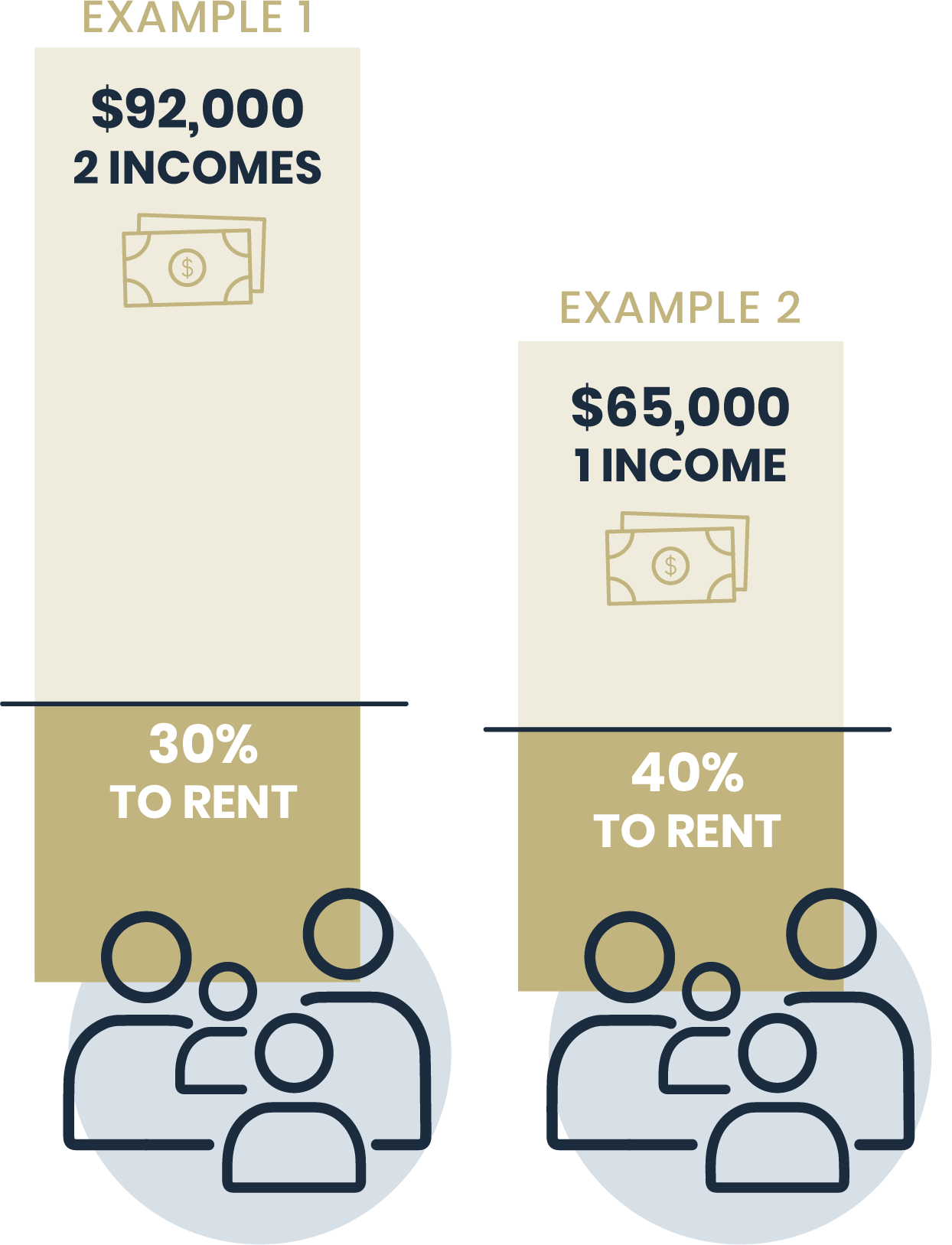

The starting point for this calculation is the Area Median Income (AMI), the midpoint household income in a specific region, meaning half of households make more and half of households make less. Moderate income is 80 to 120 percent of the AMI, low income is 50 to 80 percent AMI and very low income is 30 to 50 percent AMI. The rule of thumb is households should expect to pay about a third of their income on housing. So what does this look like in Newark?

Moderate Income: $143,050 and up for a family of four, $114,450 and up for a family of two.

Low Income: $104,400 for a family of four, $83,550 for a family of two.

Very Low Income: $65,520 for a family of four, $52,200 for a family of two.

Alameda County Household Income by Size of Household